Best Bookkeeping Services for Startups in 2026

Compare top bookkeeping services for startups including pricing, features, and specializations. Find the right financial partner for your business in 2026.

Looking for accurate bookkeeping? Sign up for Colvar.com

Get dedicated bookkeepers who understand multi-project operations. Built for businesses that outgrew automated tools but don't need enterprise pricing.

Request beta access for $99/moSelecting the right bookkeeping service determines whether your startup maintains accurate financial records or faces compliance issues and cash flow problems. Most early-stage companies cannot justify hiring full-time accounting staff, making professional bookkeeping services essential for financial operations.

This guide examines established providers serving startups in 2026, analyzing their service scope, pricing models, and ideal customer profiles. Understanding these differences helps you select a provider aligned with your current stage and growth trajectory.

Why startups use professional bookkeeping services

Expert financial management

Professional bookkeepers bring specialized knowledge of tax regulations, compliance requirements, and accounting best practices. They handle complex scenarios that automated software cannot address, including multi-state tax obligations, equity transactions, and venture debt structures.

Accurate financial reporting

Investors and board members require accurate financial statements for decision-making. Professional bookkeepers ensure your financial data meets accounting standards and provides reliable insights into business performance.

Regulatory compliance

Tax regulations change frequently and vary by jurisdiction. Professional services monitor these changes and adjust your accounting practices accordingly, reducing audit risk and ensuring timely filing of required documents.

Strategic guidance

Beyond transaction recording, experienced bookkeepers provide financial advisory services. They help with cash flow forecasting, budget planning, and financial modeling based on your specific business circumstances.

Evaluating bookkeeping service providers

Service comprehensiveness

Providers range from basic bookkeeping to full-service offerings including CFO advisory, tax preparation, and payroll management. Consider whether you need just transaction recording or more extensive financial support as you evaluate options.

Industry expertise

Some providers specialize in specific business models such as SaaS, e-commerce, or marketplace platforms. Industry-specific expertise means faster onboarding and more relevant financial guidance since the provider understands common revenue models and expense patterns.

Pricing structure transparency

Monthly subscription pricing provides budget predictability, but understand how costs scale. Some providers increase fees based on transaction volume, monthly expenses, or revenue thresholds. Request clear information about pricing tiers before committing.

Technology integration

Modern bookkeeping services integrate with banking platforms, payment processors, and accounting software. Evaluate whether a provider's technology stack works with your existing systems to avoid manual data entry and reconciliation issues.

Top bookkeeping services for startups

Fondo

![]() Fondo specializes in venture-backed startups, providing bookkeeping, tax preparation, and R&D tax credit services. Their team understands startup equity structures and venture financing requirements. Plans start at $599 monthly and include dedicated accountants familiar with startup accounting complexities.

Fondo specializes in venture-backed startups, providing bookkeeping, tax preparation, and R&D tax credit services. Their team understands startup equity structures and venture financing requirements. Plans start at $599 monthly and include dedicated accountants familiar with startup accounting complexities.

Bench

![]() Bench (acquired by Mainstreet) operates as America's largest bookkeeping provider for small businesses, using proprietary software that eliminates separate accounting platform costs. Clients retain permanent access to financial data after cancellation. Pricing begins at $199 monthly with annual billing or $189 for month-to-month plans.

Bench (acquired by Mainstreet) operates as America's largest bookkeeping provider for small businesses, using proprietary software that eliminates separate accounting platform costs. Clients retain permanent access to financial data after cancellation. Pricing begins at $199 monthly with annual billing or $189 for month-to-month plans.

Colvar

![]() Colvar emerged from direct experience managing bookkeeping across multiple business operations. After working with various providers listed in this guide, we identified recurring issues: Bench's automated approach sometimes produces inaccurate categorizations requiring manual correction, while Fondo's pricing structure—optimized for venture-backed companies with substantial budgets—often results in invoices exceeding initial expectations for smaller businesses.

Colvar emerged from direct experience managing bookkeeping across multiple business operations. After working with various providers listed in this guide, we identified recurring issues: Bench's automated approach sometimes produces inaccurate categorizations requiring manual correction, while Fondo's pricing structure—optimized for venture-backed companies with substantial budgets—often results in invoices exceeding initial expectations for smaller businesses.

Most bookkeeping services target either bootstrapped businesses with basic needs or high-growth venture companies. The gap exists for companies managing multiple projects or revenue streams who need accurate, agile bookkeeping without enterprise-level costs. Colvar addresses this specific market segment.

The service provides bookkeeping designed for companies operating multiple business units or projects simultaneously. Standard pricing starts at $249 monthly, with beta access available at $99 monthly for the first year. Colvar currently operates in private beta.

Built by Tarkle, the team behind Renlar, the service applies lessons learned from managing financial operations across multiple business entities. Request access at colvar.com.

Kruze Consulting

![]() Kruze Consulting focuses exclusively on venture-backed companies from seed through Series B stages. They provide outsourced bookkeeping, CFO services, tax preparation, and HR support. Bookkeeping services start at $650-$750 monthly and scale based on company complexity.

Kruze Consulting focuses exclusively on venture-backed companies from seed through Series B stages. They provide outsourced bookkeeping, CFO services, tax preparation, and HR support. Bookkeeping services start at $650-$750 monthly and scale based on company complexity.

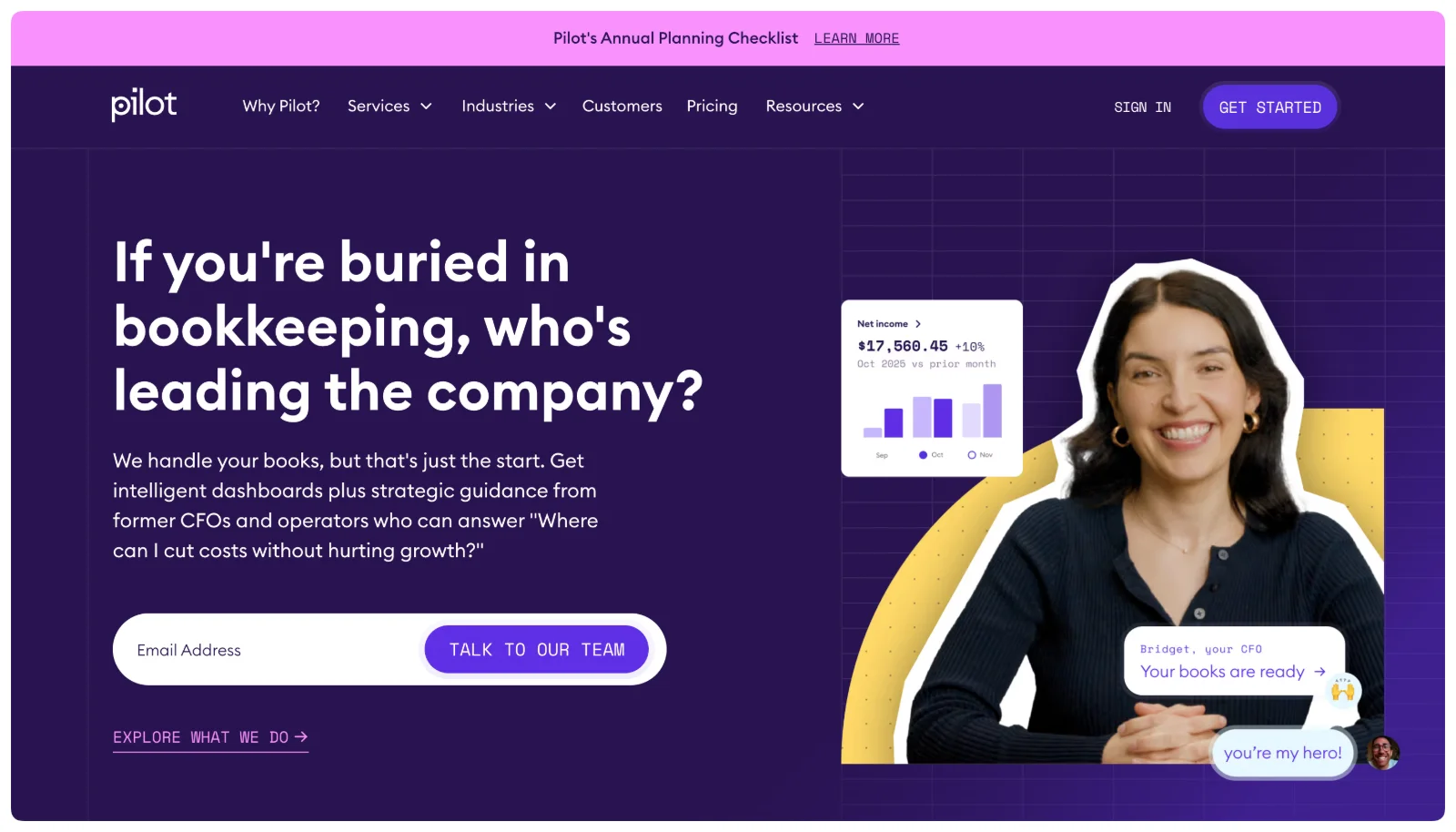

Pilot offers bookkeeping, controller, and CFO services designed for high-growth companies with substantial financial backing. Their service model assumes rapid scaling and complex financial operations. Plans begin at $199 monthly but increase significantly as transaction volume grows.

Pilot offers bookkeeping, controller, and CFO services designed for high-growth companies with substantial financial backing. Their service model assumes rapid scaling and complex financial operations. Plans begin at $199 monthly but increase significantly as transaction volume grows.

Bean Ninjas

Bean Ninjas specializes in e-commerce bookkeeping for 7- and 8-figure online businesses. They understand marketplace accounting, sales tax collection across jurisdictions, and inventory management complexities. Service pricing varies based on monthly transaction volume.

Bean Ninjas specializes in e-commerce bookkeeping for 7- and 8-figure online businesses. They understand marketplace accounting, sales tax collection across jurisdictions, and inventory management complexities. Service pricing varies based on monthly transaction volume.

Accountalent

Accountalent provides bookkeeping, tax preparation, R&D studies, and financial reporting for startups. Basic bookkeeping starts at $199 monthly, with dedicated CPA support available for $2,450 annually. Their lower price point suits bootstrapped companies with simpler financial operations.

Accountalent provides bookkeeping, tax preparation, R&D studies, and financial reporting for startups. Basic bookkeeping starts at $199 monthly, with dedicated CPA support available for $2,450 annually. Their lower price point suits bootstrapped companies with simpler financial operations.

Consider Renlar as an alternative

Renlar provides unlimited design services through monthly subscriptions for agencies and marketing teams.

Learn moreFlowFi

FlowFi matches businesses with finance professionals providing bookkeeping, accounting, and CFO services. Their network includes specialists in different industries and business stages, allowing customized team assignment based on company needs.

FlowFi matches businesses with finance professionals providing bookkeeping, accounting, and CFO services. Their network includes specialists in different industries and business stages, allowing customized team assignment based on company needs.

Inkle

Inkle offers automated bookkeeping and tax filing for US-based startups, handling state and federal compliance. Their platform emphasizes automation to reduce costs. Basic plans start at $30 monthly but require more self-service than full-service providers.

Inkle offers automated bookkeeping and tax filing for US-based startups, handling state and federal compliance. Their platform emphasizes automation to reduce costs. Basic plans start at $30 monthly but require more self-service than full-service providers.

Rillet

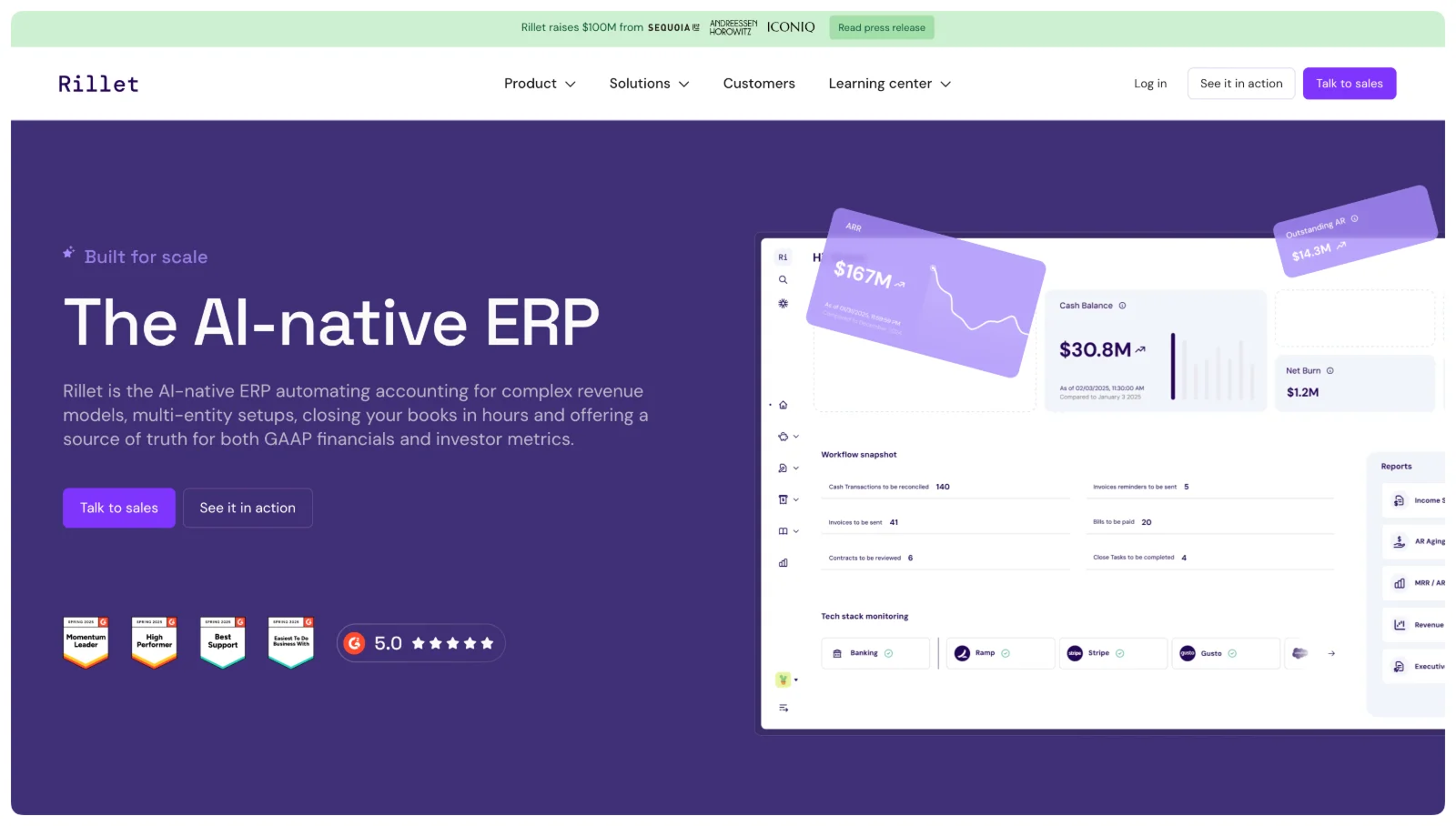

Rillet specializes in SaaS and usage-based business models, providing automated reporting and financial metrics specific to subscription companies. They understand MRR, churn, and other SaaS-specific metrics. Unlike many other legacy ERPs and point solutions, Rillet does not charge per seat or based on revenue. Rillet pricing is based on the features you use and your complexity.

Rillet specializes in SaaS and usage-based business models, providing automated reporting and financial metrics specific to subscription companies. They understand MRR, churn, and other SaaS-specific metrics. Unlike many other legacy ERPs and point solutions, Rillet does not charge per seat or based on revenue. Rillet pricing is based on the features you use and your complexity.

Outmin

Outmin is an AI-powered bookkeeping and automated accounting solution for all your financial operations. It covers bookkeeping, tax management, payroll, supplier payments, and cash flow reporting. Outmin completely removes the need for manual bookkeeping. Outmin's AI engine, Rex™, autonomously handles business bookkeeping from start to finish, providing continuously accurate, source-verified financial records without any human intervention. Outmin pricing is personalized based on monthly transaction volume; however, Renlar customers can receive a 10% discount on their quote by mentioning Renlar.

Outmin is an AI-powered bookkeeping and automated accounting solution for all your financial operations. It covers bookkeeping, tax management, payroll, supplier payments, and cash flow reporting. Outmin completely removes the need for manual bookkeeping. Outmin's AI engine, Rex™, autonomously handles business bookkeeping from start to finish, providing continuously accurate, source-verified financial records without any human intervention. Outmin pricing is personalized based on monthly transaction volume; however, Renlar customers can receive a 10% discount on their quote by mentioning Renlar.

Graphite Financial

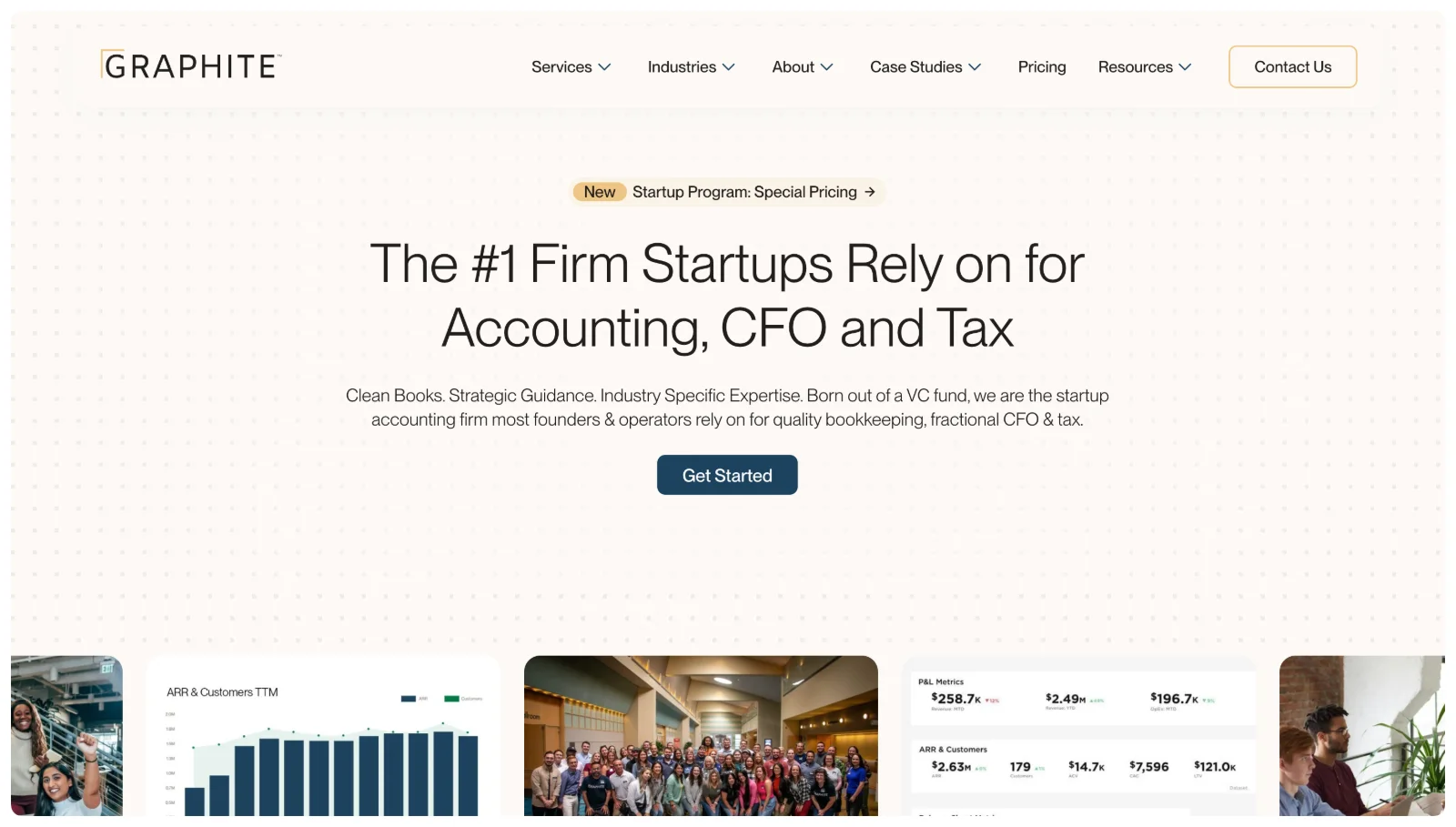

Graphite Financial serves early-stage and high-growth companies requiring strategic financial guidance beyond basic bookkeeping. Their services include accounting, financial planning, and tax preparation. Plans start at $1500 monthly.

Graphite Financial serves early-stage and high-growth companies requiring strategic financial guidance beyond basic bookkeeping. Their services include accounting, financial planning, and tax preparation. Plans start at $1500 monthly.

Zinance

Zinance provides online bookkeeping with integration to popular financial software platforms. They offer both US-based and international company support. Plans begin at $314 monthly with customization available for complex structures.

Zinance provides online bookkeeping with integration to popular financial software platforms. They offer both US-based and international company support. Plans begin at $314 monthly with customization available for complex structures.

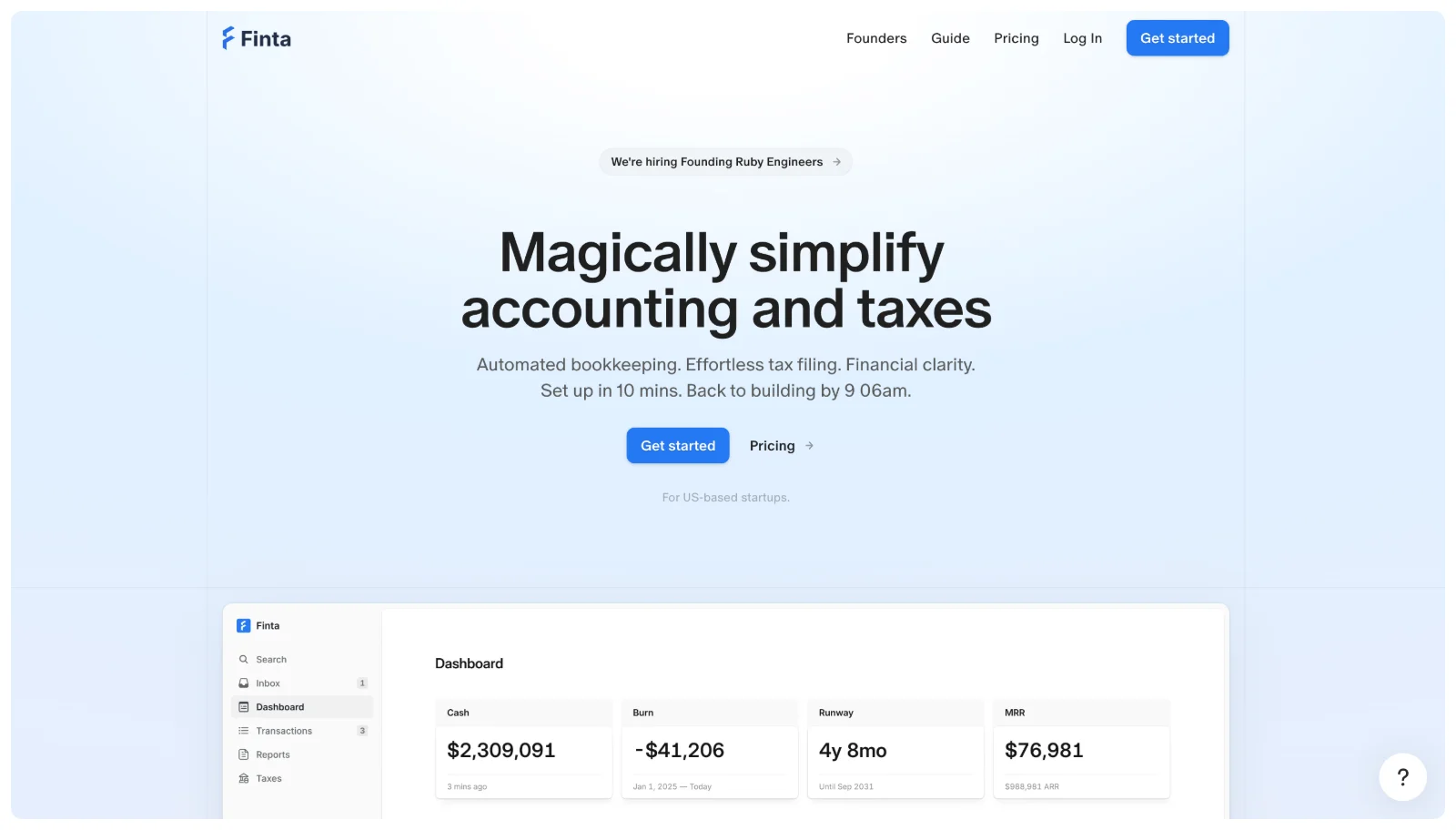

Finta

Finta offers bookkeeping, tax management, and financial statement preparation through their platform. Designed for founder-operated companies, plans start at $300 monthly with additional features available as companies scale.

Finta offers bookkeeping, tax management, and financial statement preparation through their platform. Designed for founder-operated companies, plans start at $300 monthly with additional features available as companies scale.

Less Accounting

Less Accounting provides basic bookkeeping software for expense recording, invoicing, and accounts receivable management. Their self-service model suits companies comfortable handling most accounting tasks internally. Plans begin at $399 monthly.

Less Accounting provides basic bookkeeping software for expense recording, invoicing, and accounts receivable management. Their self-service model suits companies comfortable handling most accounting tasks internally. Plans begin at $399 monthly.

Bookkeeper360

Bookkeeper360 offers bookkeeping, payroll, tax preparation, and CFO advisory for small to medium businesses. Monthly services start at $399, with pay-as-you-go options for companies needing occasional rather than continuous support.

Bookkeeper360 offers bookkeeping, payroll, tax preparation, and CFO advisory for small to medium businesses. Monthly services start at $399, with pay-as-you-go options for companies needing occasional rather than continuous support.

Punch Financial

Punch Financial positions their services as CFO-level strategy at bookkeeping prices. They focus on high-level financial planning and decision support beyond transaction recording. Services start at $1,500 monthly.

Punch Financial positions their services as CFO-level strategy at bookkeeping prices. They focus on high-level financial planning and decision support beyond transaction recording. Services start at $1,500 monthly.

Manay CPA

Manay CPA provides full-service accounting, tax preparation, and business formation expertise. They handle both ongoing bookkeeping and specific projects like entity structuring or tax planning.

Manay CPA provides full-service accounting, tax preparation, and business formation expertise. They handle both ongoing bookkeeping and specific projects like entity structuring or tax planning.

QuickBooks Live Bookkeeping

QuickBooks Live from Intuit connects businesses with verified bookkeepers while using QuickBooks software. Assisted bookkeeping starts at $15 monthly for limited support, while full-service bookkeeping costs $150 monthly.

QuickBooks Live from Intuit connects businesses with verified bookkeepers while using QuickBooks software. Assisted bookkeeping starts at $15 monthly for limited support, while full-service bookkeeping costs $150 monthly.

Tukel, Inc.

Tukel specializes in online businesses, SaaS companies, and e-commerce operations. They understand digital business models and provide bookkeeping, reporting, and tax services. Plans start at $389 monthly with custom pricing available.

Tukel specializes in online businesses, SaaS companies, and e-commerce operations. They understand digital business models and provide bookkeeping, reporting, and tax services. Plans start at $389 monthly with custom pricing available.

Fincent

Fincent combines bookkeeping software with certified bookkeepers for US-based businesses. Their hybrid approach provides automation benefits with human oversight. Plans start at $229 monthly based on expense volume.

Fincent combines bookkeeping software with certified bookkeepers for US-based businesses. Their hybrid approach provides automation benefits with human oversight. Plans start at $229 monthly based on expense volume.

Acuity

Acuity offers tiered bookkeeping and accounting subscriptions with dedicated bookkeepers and quarterly CFO insights. Premium plans include virtual bookkeeping, account management, tax services, and monthly CPA meetings. Bookkeeping starts at $399 monthly, with combined bookkeeping and accounting at $1,399 monthly.

Acuity offers tiered bookkeeping and accounting subscriptions with dedicated bookkeepers and quarterly CFO insights. Premium plans include virtual bookkeeping, account management, tax services, and monthly CPA meetings. Bookkeeping starts at $399 monthly, with combined bookkeeping and accounting at $1,399 monthly.

Professional design services for startups

Startups managing financial operations also need professional design capabilities for investor presentations, marketing materials, and product interfaces. Many companies struggle to access quality design work without agency retainers or full-time salaries.

Startups managing financial operations also need professional design capabilities for investor presentations, marketing materials, and product interfaces. Many companies struggle to access quality design work without agency retainers or full-time salaries.

Renlar provides unlimited graphic design services through monthly subscriptions. Services include brand design, marketing materials, social media content, and web development. Companies get dedicated designers who understand startup needs without managing freelancers or negotiating project quotes. Visit renlar.com for service details and pricing information.

Selecting the right provider for your business

Evaluate bookkeeping services based on your current complexity and anticipated growth. Early-stage companies with straightforward finances may find lower-cost providers sufficient, while venture-backed companies benefit from specialized startup accounting expertise.

Consider the provider's client portfolio. Services primarily working with companies at your stage understand relevant challenges and provide appropriate guidance. A provider specializing in Series B companies may offer excessive complexity for pre-revenue startups.

Request references from companies similar to yours in business model and stage. Ask about responsiveness, accuracy, and whether the provider helped identify financial issues before they became problems. Quality bookkeeping prevents costly mistakes and audit issues rather than just recording transactions.

Most providers offer initial consultations to assess fit. Use these conversations to evaluate whether the provider understands your business model, asks relevant questions, and explains their process clearly. The right bookkeeping partner becomes a trusted advisor, helping navigate financial decisions as your company scales.

Ready to scale your business?

Get professional design and development capacity without hiring overhead. Consistent quality, predictable costs, always available.

Get started